Why Zepto’s Gains may be your Losses.

Story of many loss making startups and the global middle class.

💪 Zepto is set to raise around $150 million.

But let’s explore what that means for you and me - middle-class and upper-middle-class folk - and how people are making a 6000% return at our expense, despite us never having used Zepto.

🚀 Zepto, the quick delivery startup, (which in my opinion has no hopes of ever being worth a billion dollars in India’s real markets- the public markets in the next 2 years) is raising $150 million again in this funding climate. 📈

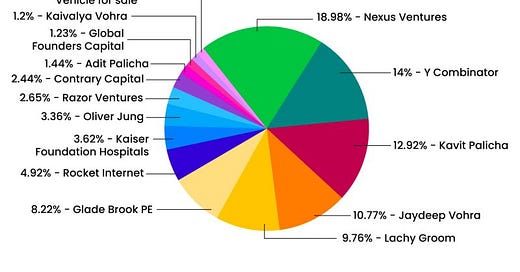

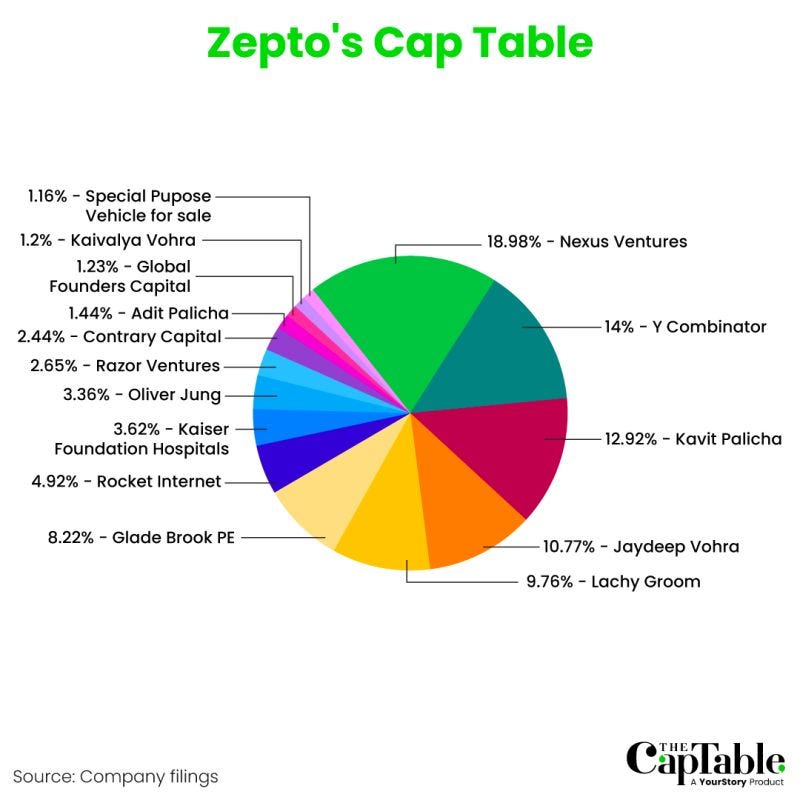

Image source- cap table by YourStory Media

Here are the key points:

The funding will help Zepto compete with rivals like Swiggy’s Instamart and Zomato-owned Blinkit, which collectively hold about 80% of the market share in India’s quick-commerce space. 🏆

Despite their dominance, these companies have faced significant losses. For example, Swiggy reported losses of $80 million in FMCG trading, while Blinkit lost around $176 million, and Zepto burned about $48 million. 📉

Investors still want growth but seek a clear path to profitability. Zepto aims to turn profitable by 2024, making the incoming funding crucial for achieving this goal. 💡

To accommodate new investors, Zepto is offering exits to some of its early backers. Eleven investors will be transferring their shares worth $9.6 million into a special-purpose vehicle through a secondary transaction. 💼

But the worse part is…

While Zepto’s path to profitability is sketchy at best, investors are already making up to 6000% returns and so are founders getting real money in the bank. Leaving the bag of c**p to public market investors when they list.

Early investors have seen substantial returns on their investments. For instance, an investor who wrote a $50,000 check for Zepto in early 2021 is expected to make around $3.1 million from this secondary exit—an impressive return of approximately 6,000%.

Marquee investors such as Oliver Jung and Global Founders Capital have also seen their holdings increase in value by over 200% during Zepto’s successive funding rounds over the past two years.

And if you are naive enough to believe that the solution is not to buy the stock when it lists -

1. Your mutual fund may buy it (happened with another undersubscribed unicorn)

2. The LP could be some PF fund with middle-class earnings somewhere in the world.

3. Or very simply a listed company like Zomato can buy it -thus adding to the middle-class burden.

This is exactly what's wrong with the current model- founders and some investors making money and the public losing theirs.

Loss-making startups have no business listing in India, and the founders earning through secondaries.

📩 Share your perspective on this scenario and find what others have to say.

Written by - Saurabh

Want to stop receiving emails from us, just click here OR want more, join 💬 WhatsApp