We predicted Nvidia fall and Nuclear growth..strange but true.

and the importance of predictions

Two big pieces of global news yesterday—and coincidentally both were part of our trends presentation this Sunday!

AI is important, yet Nvidia's market cap seems unsustainable

And there's a growing opportunity for nuclear energy 🌍 with a massive shift happening soon

Our event:

👉 Unfortunately, there was a technical issue with the LinkedIn livestream. Now you need to use third-party software, and despite trying for quite some time, we couldn’t go live.

😞

I know making this prediction sounds unbelievable, and frankly, I never thought it would happen this soon or the China angle.

But yes, we got both directions right. 🎯

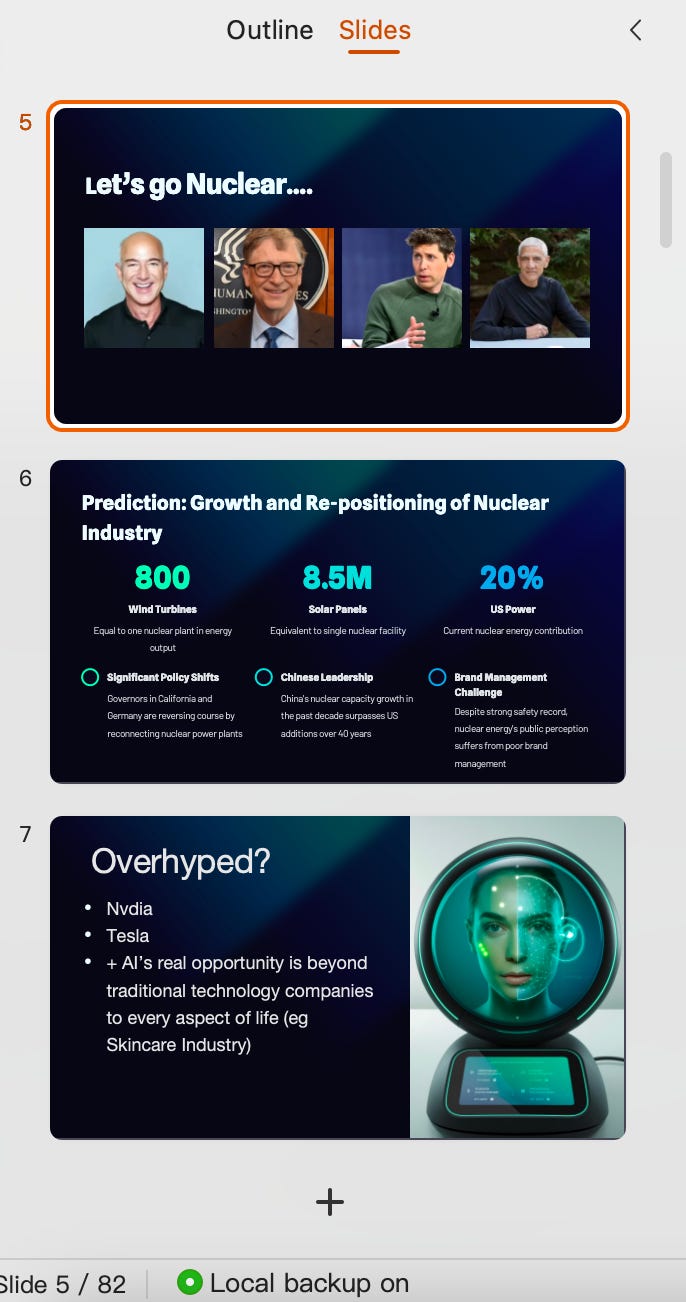

(that's why I am attaching the snaps of the relevant 3 slides. )

But what's the point of these predictions 🤔 or predictions in general?

Business is about insights, seeing where things are going and what's next. 🔍

It's like multi-dimensional chess, and insights and predictions are key to building any business.

Hard work and money are important, but everyone who runs a business, especially a startup, works hard.

What distinguishes the great ones is figuring out the direction of the wind and acting on it. 🌬️

Honestly, while I'm pretty good at the first part and helping businesses, the second part is hard.

For example, I'm currently betting on two companies to be acquired this year and have put a few lakhs on it (listed in US). But it's hard to keep believing when the stock price falls. Yet acting on the prediction is the decider. 💸

👊 The nuclear and AI prediction wasn't anything brilliant; it's just about connecting the dots.

👉 The world's top billionaires have been openly investing in nuclear. Why? That was also in our presentation (hint: it's somewhat connected to AI, and to be fair, the first time I realized the nuclear bit was thanks to Professor Scott Galloway). 🤔

👉 A similar logic with Nvidia—the numbers just don't add up, or for Tesla. 📉 Sooner or later they had to fall.

In fact I diluted my Nvidia and similar stocks around Oct last year and bought Playboy. It’s more than doubled…

______________

Two years ago, I wrote a blog on how sextech would be big in India (they are rapidly growing)

And Amazon aggregators are overhyped ie overvalued (Thrasio has since gone bankrupt, and Indian ones are struggling), and that Mamaearth's valuation would fall to below billion (0.92 billion usd currently.) 📈

And I can guarantee that if the business had understood this at the right time would have made the fall avoidable or at least delayed.

The links to those predictions:

_____

🧠

✍ And Finally:

Understanding where culture and business could be going in time can help you make changes, evolve in time to prevent damage AND seize the day.

Unfortunately we live in a business world, especially the startup world 🌍, which is forgetting the importance of analysis, insight, and strategy.

We have convinced ourselves that ‘hustle’ doesn’t require strategy and insight. Businesses are so often in a hurry to run that they forget the importance of listening-analyzing and then choosing the direction to run.

Most brands that invest effort there in a focused manner can increase their ROI appreciably with simple changes or an effective GTM play. 💡

What’s your take on predictions? Agree / Disagee

Written by - Saurabh

Check out our Podcast with Real Business Solutions https://li.sten.to/altstrategy-podcasts 📲

Want to stop receiving emails from us, just click here And for more, join 💬 WhatsApp