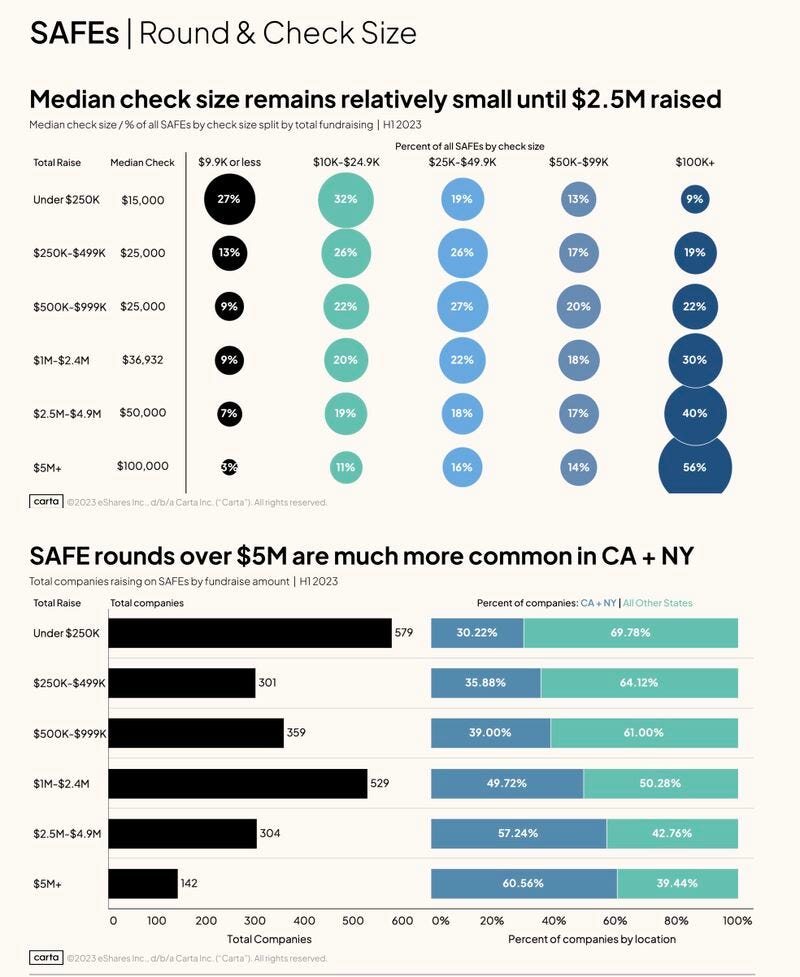

Pre Seed at below 25000$ in the US ( that's 59% of the total pre Seed in the US). Frankly, I was surprised I thought it would be much more.

source:CARTA

For those new to this, a quick explanation (others skip to the next and key para):

Pre-Seed: In the world of startup funding, the term "pre-seed" refers to the earliest stage of investment. It's the crucial period when entrepreneurs need capital to turn their ideas into viable businesses.

SAFE: A simple agreement for future equity (SAFE) is an agreement between an investor and a company that provides rights to the investor for future equity in the company.Unlike traditional equity investments, a SAFE does not specify the exact amount or percentage of equity being obtained at the time of investment. Instead, the investors receive equity when a specific trigger event occurs, such as a future funding round or acquisition. This structure provides flexibility for both parties and is commonly used in early-stage funding rounds

The low pre-seed in the US made me think-go back to first principles.

What’s the pre-seed a startup really needs to evaluate PMF?

What impact would geography have on it?

Most importantly: is there a better way to do this and thus improve the actual returns not just at the pre-seed stage but overall?

Conclusion:

What India and for that matter South East Asia really needs is a far larger number of deals but with small cheque sizes happening at that level.

🤔 Why?

🧠 We keep approaching these markets like the West but they are not.

Understanding the Market Dynamics

India and Southeast Asia have diverse economies and vastly different entrepreneurial landscapes compared to the West. Many startup founders in these regions face numerous challenges, including a lack of access to capital. The traditional approach of large investments at the pre-seed stage simply does not align with the realities on the ground.

Furthermore, there is a significant disparity in funding distribution. Currently, a select few receive substantial investments, while the majority are left struggling to secure even the smallest cheques. This imbalance not only hampers overall growth but also inhibits the achievement of product-market fit (PMF) for most startups.

Think of all those startups that received million-dollar cheques and returned them citing lack of PMF. That’s an inefficient system, you are not supposed to get millions of $ unless you are manufacturing or building hardware to get to PMF & worse if you are a skilled operator

the startup bubble is caused due to these massive early funding rounds without PMF

🧠 An idea: A New Approach to Pre-Seed Funding

Imagine a system where smaller cheques, ranging from $10,000 to $20,000, are provided to a larger number of startups at the pre-seed level in India & SE Asia (that’s around 8 to 16.6 lakh).

This approach focuses on widening the entrepreneurial ecosystem and providing opportunities to a more diverse set of founders. While there may be a higher failure rate, the successes that emerge will be far more significant.

Additionally, if these startups demonstrate promise, they could receive incremental funding of up to three times (3X-5X) their initial investment. This incremental approach ensures that the investments grow alongside the startups' progress, without overwhelming them with large amounts of capital upfront.

The Role of Automation and AI

Implementing such a system would require automation and the integration of artificial intelligence (AI) into the venture investing process.

The VC ecosystem is the first one to bet on AI but let’s be real -a big potential for AI is to disrupt & thus improve the VC ecosystem itself . Think of it:

A massive challenge with VCs is that they receive too many deals and don’t half enough time to give to those pitches (Analyzing data)

VCs are thus dependent on their own network to keep supplying deal flow. It’s often looked at as a plus but in geographies as diverse as India and SE Asia -that means missing out on large, very large segments of the population. That’s why we have multiple startups selling razors for men and deodorants (yes Indian consumers really needed them ?!) and everyone missed out on a PhysicsWallah.

Human bias especially bias with limited data set isn’t a plus. (Less Bias)

Most of our governance issues are because angels and VCs didn’t have even spend time to spend asking the right questions or evaluating the answers. I have worked with a bunch of startups in India and with a few questions, you can make out the BS ! iers . AI can do this compliance and checks are far quicker.Yes, founders can still feed fake data but within 20-30 questions you will see anomalies in the story. (Interpreting data)

CPA & LTV of consumers/Potential of business: AI is already getting better at figuring out fake vs real, it can calculate CPA also pretty accurately.LTV or Lifetime value is something when given enough data it will figure out. And with that, the real potential of a business can be figured out depending on some abstract metric like the presentation skills of the founder. (Extrapolating key business metrics)

AI can play a vital role, particularly at the junior level, in streamlining the evaluation and decision-making processes. Yes, there will be mistakes but will they be anywhere close to what is currently happening? And with time it will just keep getting better

The goal will also never be to remove the human aspect, just make it less on the initial seed and pre-seed levels.

Take smaller, incremental bets with AI. So give more money when real business goals are achieved.

By automating certain aspects, investors can efficiently manage a larger number of investments and focus on supporting the growth of promising a better, more innovative ecosystem. Genuine founders will get more of a chance with more outreach and a fairer evaluation. It’s great for the ecosystem overall.

The question is who will have the courage to disrupt themselves first? Or wait for another Kodak moment?

Hope not.

Written by - Saurabh

Looking for a deeper dive?

Subscribe to our upcoming Podcast and join the conversation today 🎤

Want to stop receiving emails from us, just click here OR want more, join 💬 WhatsApp